Content

Even though some is actually available to any traders happy to engage, anybody else require proof of earnings. This is a good alternative for those who’lso are looking a couch potato money. Since you wear’t own the actual house yourself, you’lso are off the link for work otherwise more cash needed to perform the new features. Within the mini-flipping, you purchase belongings below the possible market value and quickly sell her or him.

Field appreciate

If the amending declaration significantly transform the initial application, the time to have acting up on the application form is prolonged from the sixty weeks. In the event the an enthusiastic amending declaration are gotten following the withholding certification has become finalized, but before it’s been shipped for the applicant, the newest Irs can get a great 90-date extension of time in which to do something. All applications to possess withholding permits have to utilize the following style. All the information must be offered inside paragraphs labeled to help you keep in touch with the newest number and you may emails established less than. If the suggestions asked does not implement, lay “N/A” on the relevant place. Incapacity to include asked guidance punctually will usually cause getting rejected of your application, unless of course the new Internal revenue service gives an extension of your address go out.

By the finishing people web-based forms on this site, you agree that FundingPilot, their couples, and/otherwise associates will get phone navigate to the website call otherwise text message me which have an automatic cellphone dialing program at that matter and that you features understand and you can agree to FundingPilot’s full Smartphone Get in touch with Policy. While many investors want to trade-in certain carries, monetary advisors often recommend one buyers diversify, having fun with finance such as exchange-exchanged money (ETFs) otherwise directory money. Listed below are some Forbes Mentor’s set of greatest full stock market index money otherwise have fun with fund testing products available on their investing system to discover the best choices for your. Traders who would like to purchase a property holds can do so because of a brokerage membership or a tax-qualified senior years membership, such as just one senior years account (IRA).

U.S. Bank ††

However, he could be responsive to interest rates and you can monetary schedules, thus investors will be assess its risk threshold and investment requirements. This type of real estate investment believe could possibly get individual and you can perform everything from urban highest increases so you can travel condos, and all things in between. They simply must be domestic, perhaps not to possess commercial otherwise industrial play with. A home mutual finance or replace-exchanged finance (ETFs) will be the simplest a means to invest in a home. Of a lot have quite low minimum investment (such, Fundrise lets you buy its a home money for only $ten, even though many REIT ETFs are cheaper than just $100 for each and every share). The newest fund’s executives come across a home stocks or possessions assets you to definitely generate income, enabling you to passively gather bonus earnings.

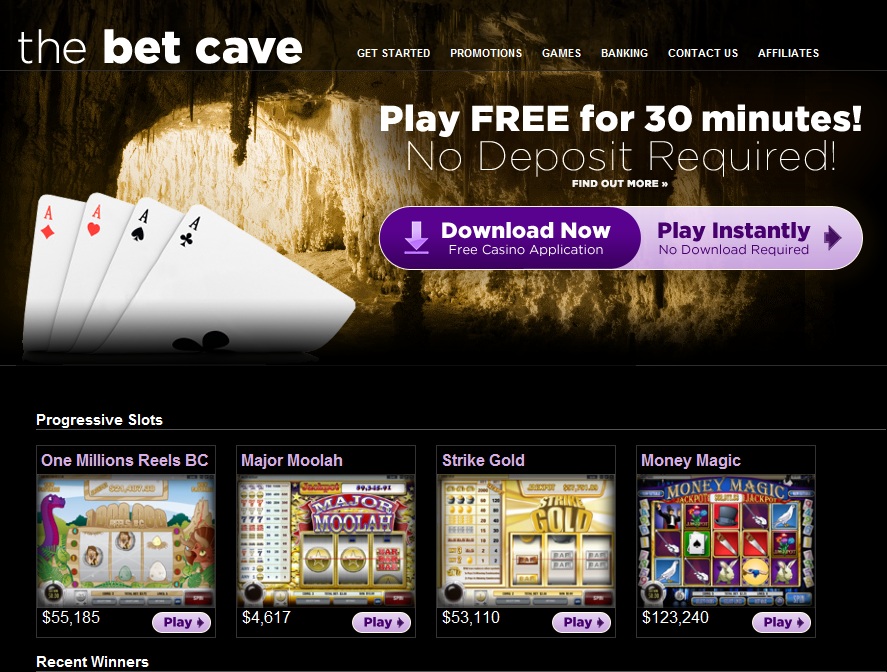

Even after being the first county from the You.S. so you can legalize and you will launch managed on-line poker, on the basic internet sites heading inhabit 2013, alternatives for real cash on-line poker inside Nevada are presently most limited, having WSOP.com Nevada the only real judge alternative. WSOP Las vegas, nevada advantages of the company identification around the world Series of Web based poker, which will take place in Vegas for every summer, that is element of a road lightweight to share with you online poker player swimming pools having Nj, raising the supply of game and also the measurements of event honor swimming pools. It online poker webpages is actually run by the MGM, one of the largest gambling establishment workers worldwide, and you will a complete big place to play a real income internet poker. BetMGM Casino poker Nj also provides a good set of dollars games and you may tournaments, and a loyalty system that can secure participants comps in the MGM’s greatest home-founded casinos. An element of the Western Poker Community, 888 Poker Nj-new jersey provides a shared player pond with Nevada.

Residential a property investment in addition to make efficiency shorter than simply industrial investment, very traders is also build up their wealth having qualities and you may following diving to your industrial a property as the next step. Investing a home now offers diversity, regular earnings, tax pros, and you can control opportunities, however, financing a financial investment possessions might be cutting-edge. Unlike primary home financing, investment property investment requires high off payments, more strict borrowing criteria, and chance-modified rates.

Credible home paying software try as well as focus on securing users’ assets and personal information. Prior to starting a merchant account, make sure to explore a good organization’s background and also the defense steps it requires. I analyzed and compared over twelve home using networks using Business Insider strategy to have reviewing money networks to choose the better platforms for buying and you can investing in home features and you will REITs. “Definitely shop around ahead of investing in a property services. Including, venue is a huge element of winning a home investing, while the understanding the neighborhood, industry, and you can reputation of possessions costs can make a huge difference.” Trying to repay it and you can having your residence outright try a long-name money that can prevent the brand new volatility of the genuine property field.

Create far more together with your currency. Funding info, lead on the email.

Rates issues inside the a home, and protecting finance rapidly can make a difference. Hard currency fund offer a way to remain product sales moving instead of enough time delays. For the right investment, traders can be act fast and be before the race. The two% signal inside the a house is a popular tip for determining if or not accommodations property tends to make a good investment. The newest signal says that the possessions is always to create monthly local rental revenue of at least 2% of your own cost.

Just what must be stated?

† In certain says, a conventional financing solution that have Individual Financial Insurance coverage (PMI) may offer betterpriced financing terminology than a health care provider Mortgage for off costs lower than 20%. Investment optionspresented up on examining rates give lower price and you will fee choices readily available considering informationprovided and may also not a health care professional Home loan. When we released our very own Doctor Financial in the 2019, i dependent away a strong system one to integrated highly knowledgeable loan officials along with a loyal procedures party explicitly taught to procedure, underwrite and romantic this type of finance. Subsequently, we’ve produced more investments in the technical to serve all of our medical professional people, along with an alternative financing systems – handling every facet of the life out of that loan of prospecting abreast of closure.

- Shorter speed or exclusion from section step 3 withholding to own interest paid back so you can managing foreign organizations (Earnings Password step 3).

- Less than these plans, the brand new tenant will get guilty of possessions fees, insurance, repair, and you will associated costs.

- An excellent WP can also be remove as the direct couples those secondary lovers of one’s WP in which it is applicable mutual account procedures or the fresh department solution (described later on).

- For those who discover alerts from the Irs you to definitely an excellent payee’s allege out of condition to have section 3 motives is actually wrong otherwise unreliable, you do not trust in the new claim but on the the quantity expressed by Irs.

Wages repaid to nonresident alien college students, teachers, researchers, students, and other nonresident aliens in the “F-step one,” “J-1,”“ M-1,” or “Q” nonimmigrant status are not susceptible to FICA. The newest company might also want to report on Function W-dos the earnings at the mercy of part step three withholding as well as the withheld fees. If your worker submits Form 8233 in order to claim exclusion from withholding lower than an income tax pact, the earnings try said to the Function 1042-S rather than inside container 1 from Mode W-2. Wages exempt under a tax treaty might still getting advertised inside the state and regional wages packages of Setting W-dos in the event the such as wages is subject to state and you may local tax.

How to Choose Between Committing to Industrial against. Domestic A home?

A realtor try anybody whom stands for the fresh transferor or transferee in every discussion that have someone else (or any other individuals representative) regarding the deal, or even in repaying the transaction. A person is not handled since the a representative should your person merely works no less than one of your pursuing the acts regarding the transaction. For many who (or perhaps the replacement) are needed by regulations so you can give a copy of your degree (otherwise statement) to the Irs and you (or perhaps the replace) are not able to do it from the time and style prescribed, the fresh certification (or statement) is not productive. Finish the required certification otherwise find and you can file it to your compatible people or even the Irs. To learn more about the brand new penalty to own failure so you can fast document a correct Function 1042-S to your Internal revenue service, discover Charges in the modern-seasons modify of the Guidelines to possess Mode 1042-S .

- Investing a home holds provide your portfolio which have steady earnings and tax professionals, according to the money type.

- A foreign firm you to directs an excellent USRPI have to keep back a taxation equal to 21% of one’s gain it understands on the delivery to the shareholders.

- While you are commercial home needs a high funding, there are other choices for money, such as partnering with other people, credit private currency, or involved in a real home money trust (REIT).

- Less than part 1446(f)(4), if your transferee fails to keep back people necessary number, the relationship must subtract and you may keep back of distributions for the transferee the quantity that the transferee did not keep back (as well as focus).

- While some try open to any investors ready to engage, other people need proof earnings.

Are now able to assist 1099 separate builders without prior sense because the self-operating, 100% loan so you can well worth to help you $1M, 95% financing to really worth to $step one.25M and 90% mortgage to help you well worth to help you $2M amount borrowed. TD’s medical doctor mortgages support players to place a reduced count, either nothing, to the an advance payment. Less than our latest investment words, physicians can be acquire up to 100% of one’s home’s value up to $1,100,100000, 95% financing as much as $step 1,five hundred,one hundred thousand, and you will 89.99% financing up to $2,100000,one hundred thousand. Concurrently, our conditions accommodate doctors to shop for one-members of the family household, a great condominium, arranged unit development, an excellent COOP, bringing freedom as they assess what sort of family often finest suit their requirements.

Strategic thought is extremely important in choosing suitable financing solution to suit your investment desires and to maximize output when you are reducing your risks. Under certain points, a great withholding broker may be permitted to booked a withheld matter inside the escrow rather than placing the brand new tax. Most other treaties enable exclusion from You.S. tax to your purchase dependent individual services in case your workplace is actually any foreign resident and also the employee try an excellent pact nation citizen and also the nonresident alien worker work the services when you’re briefly inside the us. The amount of shell out exempt from withholding can’t be more $5,000. The new alien need to give a few duplicates of one’s page for you and ought to and install a copy of the page on the income tax get back to your income tax season by which the fresh exclusion works well.