Articles

You could choose to make an effort to secure that it incentive that have you to definitely of about three additional accounts. Which lender added bonus https://happy-gambler.com/kiss/rtp/ try reduced and the incentive requires prolonged in order to be paid compared to most other also provides for the our list, but requirements are simple. The benefit isn’t as large as some others about number, but it lender campaign would be advisable for many who don’t should fulfill a primary deposit requirements to earn a cash prize.

The size of a difference do the brand new RTP make?

Whenever Chairman Roosevelt instituted a financial holiday in 1933, all financial institutions were ordered to prevent operations up to these people were calculated solvent. It was the beginning of the end of the lending company works, nevertheless pain try away from more. Complete, this type of works, and also the financial impact of one’s stock exchange crash triggered the brand new inability around 9,100 banking companies on the 1930s.

- The definition of ‘s the timeframe that the money remains stashed in the membership.

- The newest inquiries centered on just how deposit insurance rates is actually funded and you may the new do it from discretion within the dealing with bank failures.

- Meanwhile, company commission profile can get pose deeper monetary stability concerns than many other account since the the inability to access those individuals profile might result within the larger monetary outcomes because of failure to make payrolls.

- It could voice challenging, although not, let’s guide you how to hobby that it tiny amount for the a good-looking currency.

- If the down maximum victories on the video game disinterests your, and you may you prefer to enjoy to your ports which have highest max victories, you can try Miracle Mirror Luxury 2 which have a great 50000x max victory or Dollars Stax having a x maximum victory.

- Our editorial party gets zero direct payment of advertisers, and our very own posts try thoroughly facts-searched to ensure reliability.

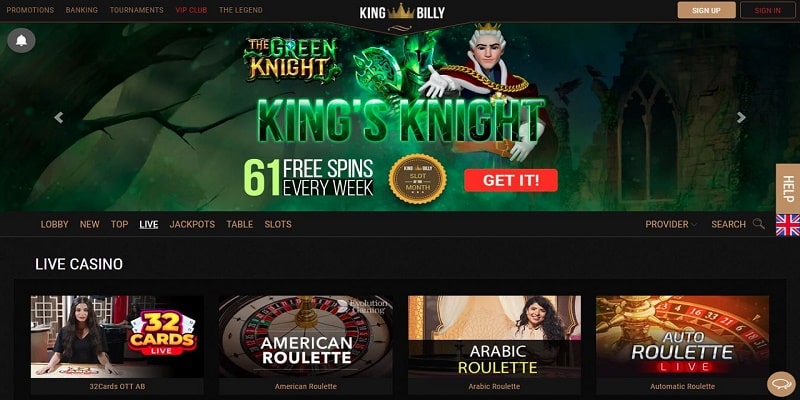

Usa people will get become because of the joining from the certainly all of our award winning minimal casinos to own 2025 today. Already, Pursue people can also secure 50 for every buddy just who reveals a good qualifying checking account (up to five-hundred per twelve months). When it’s time to finest up the account, it’s always best if you enjoy during the all of our best-rated online websites that provide several financial steps and you may currencies. The new 1 lowest put online casinos offer a handy sense to possess international participants, that have simple dumps inside local money, making it easy to monitor. Users can begin to play thebest game at the our better step one minimum deposit casinos, with several secure put available options inside the 2025. This can be among the best slot machine game i have ever starred i am also most hooked on which slot.

- In addition, it demands for every Eu Representative Condition to need the financial institutions to participate in the home state put be sure strategy, with their twigs various other member states (server Affiliate Says) and protected by the home condition put make sure strategy.

- United states users kept at least 151.5 billion inside the uninsured deposits towards the end of 2022, SVB’s current annual statement said.

- Centered in the 1983, Silicon Valley Lender provided funding for pretty much half You venture-recognized tech and you may health care businesses.

- Specifically, I can mention trick improvements in the European union and can draw specific contrasting for the reputation for the device in america.

Latest Vio Lender Computer game Prices

Bankrate has partnerships with issuers along with, however limited to, American Show, Financial from The usa, Investment One to, Pursue, Citi and discover. We wear’t block you in the panic-causing statements, and we’re maybe not obsessed with being the very first to-break the news. Finding the right mixture of high yearly commission output (APYs), lower fees, time-rescuing digital devices, department availableness (if that’s important to your) and other provides might need additional time than your’re also willing to spend.

Immediately after generating his MBA out of Northwestern inside the 2013, Todd sooner or later entered their dad from the Independence, in which he held some jobs, in addition to vp out of business means. One of his true basic accomplishments are convincing better banking companies—as well as JPMorgan Chase, Financial out of The usa, and you can Citi—to expend 30 million in the Freedom. You to assisted meet government mandates away from investment-to-investment ratio whenever financial institutions go beyond step 1 billion. Centered in the 1972, Freedom has grown away from dos million inside the possessions so you can over step 1 billion. With regards to the Government Put Insurance policies Corporation (FDIC), the lending company has 948 million inside dumps, so it’s the most significant lender to possess Black colored Americans because of the asset dimensions.

Skrill try preferred due to their e-wallet program, enabling gamers and then make immediate places and you may quick cash outs of other sites for example gambling enterprises inside 2025. You have to know one to Skrill deals provides a dos.99percent payment when giving currency, however, you to definitely should not number excessive to possess min. put gambling establishment costs. The new Canadian bodies has not banned on the internet gaming for example during the sporting events web sites. Although not, the businesses are meant to end up being registered inside the an area province inside Canada.

Depositors Was Secure Inside the Credit crunch

The newest megabank’s following 4th-quarter income writeup on Jan. 16 will be an opportunity for government so you can reaffirm such positive manner and set the new build for the inventory regarding the the new 12 months. Financial out of America (BAC -9.25percent) investors provides a whole lot to help you celebrate supposed on the 2025. The blend away from a resilient economy, climbing financial asset costs, and you can optimism for the lending conditions has propelled the fresh inventory so you can an excellent big 29percent get back during the past 12 months. “Develop they’re going to join united states within these efforts to decide in which end users’ finance is actually and also have them to end pages.”

“The likes to gamble bodies against each other,” told you Ed Mills, Arizona coverage specialist from the Raymond James. “All of our financial regulating structure is absolutely nothing lacking a great Frankenstein’s monster,” told you Isaac Boltansky, movie director out of coverage lookup at the BTIG. Steve Moore, an old-fashioned economist who may have advised Trump, advised CNN the guy’s “opposed to shutting” on the FDIC, whether or not the guy did say there’s a need to consolidate financial regulators. “This really is one of several dumbest info somebody could have, and it also’s a representation from exactly how very away from reach billionaires are,” said Dennis Kelleher, Chief executive officer out of Finest Segments, a federal government watchdog concerned about financial change. Certain just who argue to have more difficult controls away from big banking companies was dismayed by idea of shutting the fresh FDIC.

Still, Lender out of America is appearing it stays extremely relevant and in a position to away from navigating an ever-growing community land. The new FDIC try for this reason to be concerned about warnings one to will likely be misinterpreted. Mistrust away from larger banks is widespread now, but collapsing him or her suddenly because of a “disorderly” across the country financial focus on might possibly be as the catastrophic as it was in the brand new 1930s. Before FDIC try centered through the Financial Work from 1935, depositors routinely forgotten their money whenever their banks went broke. Greatest will be on the government to relax the new speculative SIFI bets within the a “soft getting” whenever possible. Franklin D. Roosevelt stated a nationwide lender holiday; and when the banks reopened, home-based dumps had been not any longer backed by gold.