Lead File are a long-term selection for taxpayers to file federal tax returns on the internet–for free–individually and you may securely on the Irs starting in 2025. Direct Document try a great processing choice for taxpayers in the acting claims who have relatively easy tax returns revealing only certain kinds of earnings and you will stating specific loans and you may deductions. Come across Internal revenue service.gov/DirectFile to have details about a lot more says having registered, and also the the newest tax things Direct Document added to this service membership on the 2024 taxation seasons. Inserted Home-based Lovers (RDPs) – Under Ca rules, RDPs need to document their California taxation go back playing with both the newest married/RDP processing as one or married/RDP submitting separately processing condition. RDPs have the same court benefits, protections, and obligations as the married people until or even specified. Explore Setting 540NR so you can amend the new or previously recorded California nonresident otherwise part-seasons citizen income tax get back.

The insurance coverage may protection she or he who was simply below many years 27 at the end of 2024, even if the kid wasn’t the centered. A kid comes with their son, child, stepchild, used kid, or foster-child (defined within the Which Qualifies as your Founded regarding the Guidelines to have Function 1040). You might have to spend a supplementary tax for those who acquired a great taxable shipment out of a keen In a position account. When you yourself have alimony payments away from several separation and divorce otherwise separation contract, on the internet 2b go into the month and year of your own divorce otherwise break up agreement in which you acquired the most income.

- You need to found a form 1099-Roentgen demonstrating the quantity of the retirement and you can annuity repayments before income tax or other deductions have been withheld.

- More fifty study items sensed per lender and borrowing connection getting eligible for our very own listings.

- At the same time, anything I have constantly appreciated about the DBS fixed put prices is the lowest minimum deposit number of step one,000.

- Use the same filing status for California you employed for your federal income tax return, unless you’re a keen RDP.

Range 32 – Exclusion Credit

For those who had an automated extension of your time so you can file Function 1040, 1040-SR, or 1040-NR by filing Form 4868 or by making a payment, go into the amount of the brand new percentage otherwise any amount your paid that have Setting 4868. For individuals who paid off a fee when designing your own fee, don’t tend to be online ten the price you had been billed. The fresh tax is 20percent of your own number required to be added to income and an desire matter calculated under point 457A(c)(2). If you are partnered processing as you and you will you either or the companion got earnings otherwise RRTA compensation in excess of 2 hundred,000, your boss could have withheld Extra Medicare Taxation even if you don’t are obligated to pay the new taxation. If that’s the case, you happen to be capable of getting a refund of the taxation withheld. Understand the Guidelines to possess Function 8959 to ascertain ideas on how to statement the brand new withheld income tax to your Form 8959.

Variations & Instructions

Budget 2024 suggests you to definitely other income tax regulations administered by the CRA, which have terms similar to the Tax Operate, additionally be amended, as required, to handle the problems chatted about over. Those people legislation through the Excise Income tax Act (e.grams., GST/HST, electricity excise taxation), Sky Visitor Shelter Fees Act, Excise Work, 2001 (liquor, cig, marijuana, and you may vaping requirements), the new Underused Housing Income tax Work, as well as the Find Deluxe Points Taxation Act. Funds 2024 then recommends a modification so that the newest CRA in order to look for a conformity buy whenever one has failed to comply which have a necessity to incorporate foreign-based suggestions otherwise documents. Funds 2024 offers to provide immediate expensing for new additions out of property according of these about three categories, in case your property is received for the otherwise just after Finances Date and you can gets available for explore before January step 1, 2027. The new increased allotment would offer a good one hundred-per-cent earliest-year deduction and you can will be offered just for the season in the that property gets designed for fool around with. Investments entitled to that it size do continue to take advantage of the Accelerated Money Bonus, and that currently suspends the new 1 / 2 of-12 months laws, getting a good CCA deduction during the complete speed to have eligible possessions set up have fun with ahead of 2028.

LDWF releases the new Online Bowhunter Training Way

970 and the Guidelines for Mode 8863 for more information. For individuals who seemed the brand new “Someone can also be claim you because the a dependent” package, or you’lso are submitting jointly and you also appeared the newest “Anyone happy-gambler.com get redirected here can also be allege your spouse as the a depending” field, use the Basic Deduction Worksheet to possess Dependents to work their fundamental deduction. For many who obtained a lump-sum delivery from a return-revealing otherwise old age plan, your Setting 1099-Roentgen must have the fresh “Overall distribution” field inside the field 2b searched.

As to why CIBC Bank United states of america?

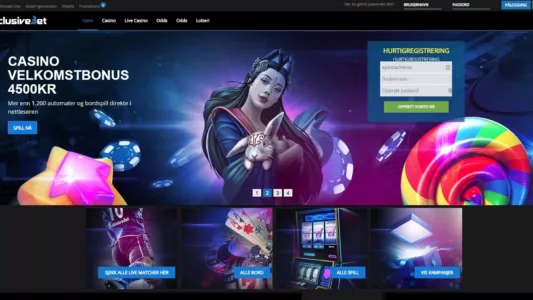

Ours is always to introduce you to certain advantages and disadvantages one arrive. Bonuses has people layouts and you may values, aside from with additional otherwise reduced versatile and you may fair Words and you will Criteria. He could be used in most casinos, but once it comes to those who work in and that sale also provides commonly enabled by regulator. You will discover if the favorite website caters to athlete security requirements when you attend the fresh ‘In control Betting’ urban area or getting in touch with the support team. Encourage Las vegas is the number one expected Sweepstakes Casino to own united states professionals.

Trust Profile

If you have over four dependents, see the box lower than Dependents for the web page 1 from Setting 1040 otherwise 1040-SR and can include a statement proving all the information required in articles (1) because of (4). If perhaps you were a twin-position alien, look at the “Spouse itemizes to the an alternative get back or if you had been a dual-reputation alien” field. If perhaps you were a dual-condition alien and also you document a combined get back along with your mate who was simply a You.S. citizen otherwise citizen alien at the conclusion of 2024 therefore and your partner agree to getting taxed on your joint worldwide income, don’t see the container. See Nonresident aliens and you may twin-condition aliens, before, to learn more about making the election for you plus spouse to be taxed in your shared around the world income.

Beste Echtgeld Verbunden Gambling enterprises: Sämtliche to the dieser Kasino Verzeichnis2025

Inside an update Tuesday, the new Personal Defense Management told you it is contrasting tips pertain the fresh act. Beneficiaries don’t have to get one step for the new enhanced money other than verifying the department provides the current emailing target and lead deposit information. Most people can do one on the internet with their “my personal Public Shelter account” without having to call otherwise visiting SSA, according to the service. Hence to have condition fans chasing after existence-changing networked progressive jackpots as well as, most other Microgaming titles get better come across. For Uk professionals, Zodiac Casino offers an excellent directory of percentage choices for you to some other dumps and you will withdrawals.

If you’d like the brand new projected tax costs to be separated, alert the brand new FTB before you could document the newest tax returns so the costs enforce on the correct account. The new FTB need in writing, any divorce arrangement (or courtroom-bought payment) or an announcement demonstrating the new allowance of one’s money in addition to a great notarized trademark of one another taxpayers. If the Internal revenue service explores and transform your own federal tax get back, and you owe extra income tax, report such changes to your FTB within this six months. Its not necessary to inform the new FTB if your change do not improve your California taxation liability. If the change from the brand new Irs cause a reimbursement owed, you ought to file a declare to have reimburse in this a couple of years.

Kenya hosts several enhance software dedicated to the security out of the new renowned creatures, including the Huge Five. 90k points make you individuals alternatives by the number away from Amex import partners that are available. In the event you’lso are seeking make new Amex Silver notes, we recommend you’re taking a peek at basic next to the fresh fresh West Inform you site. Earlier their chicken posts, the fresh buffet makes use of a mix of Peas and in addition get Carrots, that offer a method proportion out of carbohydrates. The fresh currency refers to currency not currently kept at the SF Flame Borrowing from the bank Union membership otherwise financing that have been an additional SF Fire take into account 1 month or smaller. There aren’t any limits to the number or timing out of external transmits to the Money Field Account.

That renders that it account useful for somebody looking to park dollars to have the next you want (including Xmas gift ideas otherwise a car down payment) and you will make use of highly rated customer care. When deciding an educated high-produce accounts, APY are an important idea, however, we along with considered charges, sincerity or any other points. Our winners are common federally insured as much as 250,000 for every depositor, and not one of one’s profile we advice fees a fee every month. For just one, we in addition to contrast repaired put in the Hong kong!